एसआईपी 2022 के लिए 11 सर्वश्रेष्ठ म्युचुअल फंड

सिप म्यूचुअल फंड्स (या शीर्ष 11 एसआईपी म्यूचुअल फंड) ऐसे फंड हैं जो शेयर बाजार के अपरिहार्य उतार-चढ़ाव के दौरान घबराहट से बचने के लिए आवधिक निवेश के सरल फार्मूले का पालन करते हैं।

आमतौर पर, एसआईपी या व्यवस्थितनिवेश योजना म्यूचुअल फंड में पैसा निवेश करने का एक तरीका है।निवेश शीर्ष 11 में एसआईपी म्युचुअल फंड आपके निवेश के लिए एक व्यवस्थित और अनुशासित दृष्टिकोण लाता है। यह आपके निवेश को दैनिक रूप से प्रबंधित करने के आपके प्रयास को कम करता हैआधार. इसके अलावा, यह का उत्तोलन प्रदान करता हैकंपाउंडिंग की शक्ति समय के साथ वांछित रिटर्न की ओर अग्रसर।

वह अलग अलग हैम्यूचुअल फंड के प्रकार एसआईपी के लिए जिसमें इक्विटी, डेट, बैलेंस्ड, अल्ट्रा-शॉर्ट टर्म फंड्स, आदि। हालांकि, इक्विटी म्यूचुअल फंड एसआईपी के माध्यम से निवेश करने पर अधिकतम रिटर्न प्रदान करते हैं। वित्तीय सलाहकारों का सुझाव है कि, निवेशकों को इसमें निवेश करना चाहिएसर्वश्रेष्ठ म्युचुअल फंड एसआईपी के आधार पर उनके निवेश के उद्देश्य और अवधिएसआईपी निवेश.

टॉप 11 एसआईपी फंड में निवेश क्यों करें?

एसआईपी म्यूचुअल फंड में निवेश करने के लिए अनुशासित दृष्टिकोण देते हैं

व्यवस्थित निवेश भविष्य के सपने और प्रमुख लक्ष्यों जैसे- सेवानिवृत्ति, बच्चे का करियर, घर, कार या किसी अन्य संपत्ति की खरीद के वित्तपोषण में मदद करता है।

एसआईपी कंपाउंडिंग का अधिकतम लाभ उठाने में मदद करते हैं और युवा निवेशकों के लिए आदर्श हैं

व्यवस्थित निवेश योजनाएं इक्विटी में उतार-चढ़ाव के जोखिम को कम करती हैं

एसआईपी में निवेश कैसे करें?

पैसा निवेश करना एक कला है, अगर इसे सही तरीके से किया जाए तो यह अद्भुत काम कर सकता है। अब जब आप जानते हैंशीर्ष एसआईपी योजनाओं में आपको पता होना चाहिए कि इसमें निवेश कैसे करें। हमने नीचे SIP में निवेश करने के चरणों का उल्लेख किया है।

1. अपने वित्तीय लक्ष्यों का विश्लेषण करें

एक एसआईपी निवेश चुनें जो आपके अनुकूल होवित्तीय लक्ष्यों. उदाहरण के लिए, यदि आपका लक्ष्य अल्पकालिक है (यदि आप अगले 2 वर्षों में कार खरीदना चाहते हैं), तो आपको डेट म्यूचुअल फंड में निवेश करना चाहिए। और, यदि आपका लक्ष्य दीर्घकालिक है (जैसेसेवानिवृत्ति योजना) तो इक्विटी म्युचुअल फंड में निवेश करना पसंद करते हैं।

2. निवेश का समय चुनें

यह सुनिश्चित करेगा कि आप सही समय के लिए सही राशि का निवेश करें।

3. वह राशि तय करें जिसे आप मासिक निवेश करना चाहते हैं

चूंकि एसआईपी एक मासिक निवेश है, इसलिए आपको एक ऐसी राशि का चयन करना चाहिए, जिसके बिना आप मासिक रूप से निवेश कर सकेंविफल. आप अपने लक्ष्य के अनुसार उपयुक्त राशि की गणना भी कर सकते हैंघूंट कैलकुलेटर या एसआईपी रिटर्न कैलकुलेटर।

4. सबसे अच्छा SIP प्लान चुनें

सलाह-मशविरा करके निवेश का बुद्धिमानी से चुनाव करेंवित्तीय सलाहकार या चुनकरसर्वश्रेष्ठ एसआईपी योजनाएं विभिन्न ऑनलाइन निवेश प्लेटफार्मों द्वारा की पेशकश की।

Talk to our investment specialist

भारत में शीर्ष 11 एसआईपी म्युचुअल फंड वित्त वर्ष 22 - 23

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. Research Highlights for ICICI Prudential Infrastructure Fund Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. Research Highlights for DSP India T.I.G.E.R Fund Below is the key information for DSP India T.I.G.E.R Fund Returns up to 1 year are on T o g e n e r a t e income/capital appreciation by investing in equities and equity related instruments of companies in the infrastructure sector. However, there can be no assurance that the investment objective of the scheme will be realized. Research Highlights for Canara Robeco Infrastructure Below is the key information for Canara Robeco Infrastructure Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Research Highlights for Franklin Build India Fund Below is the key information for Franklin Build India Fund Returns up to 1 year are on The investment objective of the scheme is to provide long term growth from a portfolio of equity / equity related instruments of companies engaged either directly or indirectly in the infrastructure sector. Research Highlights for LIC MF Infrastructure Fund Below is the key information for LIC MF Infrastructure Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. Research Highlights for HDFC Infrastructure Fund Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Research Highlights for Nippon India Power and Infra Fund Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on The Scheme seeks to generate long term capital appreciation through a portfolio of predominantly equity and equity related securities of companies engaged in manufacturing and infrastructure and related sectors. Further, there can be no assurance that the investment objectives of the scheme will be realized. The Scheme is not providing any assured or guaranteed returns Research Highlights for BOI AXA Manufacturing and Infrastructure Fund Below is the key information for BOI AXA Manufacturing and Infrastructure Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹63.9103

↓ -2.35 ₹1,975 500 28.7 64.3 164.1 58.8 31 167.1 SBI PSU Fund Growth ₹36.0126

↓ -0.17 ₹5,980 500 8.2 16.7 28.2 32.2 26.7 11.3 Invesco India PSU Equity Fund Growth ₹67.37

↑ 0.19 ₹1,492 500 4.1 10.5 26.8 30.2 24.7 10.3 ICICI Prudential Infrastructure Fund Growth ₹188.58

↓ -1.04 ₹8,077 100 -3.7 -1.7 10.4 22.8 24.6 6.7 DSP India T.I.G.E.R Fund Growth ₹320.958

↓ -0.49 ₹5,184 500 3 3 18.6 25.4 23.4 -2.5 Canara Robeco Infrastructure Growth ₹162.55

↓ -0.09 ₹879 1,000 3.1 2 18.1 25.3 22.8 0.1 Franklin Build India Fund Growth ₹143.766

↓ -0.94 ₹3,003 500 0.8 2.9 17.1 26.2 22.7 3.7 LIC MF Infrastructure Fund Growth ₹49.1602

↑ 0.07 ₹946 1,000 1.1 1.4 17.4 27.8 22.5 -3.7 HDFC Infrastructure Fund Growth ₹45.58

↓ -0.41 ₹2,366 300 -3.6 -3.1 11.1 24.6 22.4 2.2 Nippon India Power and Infra Fund Growth ₹345.453

↑ 0.02 ₹6,773 100 0.8 1.7 15.5 25.2 22.4 -0.5 BOI AXA Manufacturing and Infrastructure Fund Growth ₹58.15

↓ -0.08 ₹661 1,000 0.1 3.2 20.5 24.1 21.2 7.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 5 Mar 26 Research Highlights & Commentary of 11 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund Invesco India PSU Equity Fund ICICI Prudential Infrastructure Fund DSP India T.I.G.E.R Fund Canara Robeco Infrastructure Franklin Build India Fund LIC MF Infrastructure Fund HDFC Infrastructure Fund Nippon India Power and Infra Fund BOI AXA Manufacturing and Infrastructure Fund Point 1 Lower mid AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Lower mid AUM (₹1,492 Cr). Highest AUM (₹8,077 Cr). Upper mid AUM (₹5,184 Cr). Bottom quartile AUM (₹879 Cr). Upper mid AUM (₹3,003 Cr). Bottom quartile AUM (₹946 Cr). Lower mid AUM (₹2,366 Cr). Top quartile AUM (₹6,773 Cr). Bottom quartile AUM (₹661 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (16+ yrs). Established history (20+ yrs). Established history (21+ yrs). Established history (20+ yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (18+ yrs). Oldest track record among peers (21 yrs). Established history (16+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (lower mid). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 4★ (top quartile). Not Rated. Top rated. Not Rated. Rating: 3★ (lower mid). Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 30.96% (top quartile). 5Y return: 26.72% (top quartile). 5Y return: 24.66% (upper mid). 5Y return: 24.56% (upper mid). 5Y return: 23.39% (upper mid). 5Y return: 22.80% (lower mid). 5Y return: 22.67% (lower mid). 5Y return: 22.54% (lower mid). 5Y return: 22.44% (bottom quartile). 5Y return: 22.40% (bottom quartile). 5Y return: 21.16% (bottom quartile). Point 6 3Y return: 58.76% (top quartile). 3Y return: 32.21% (top quartile). 3Y return: 30.16% (upper mid). 3Y return: 22.82% (bottom quartile). 3Y return: 25.38% (lower mid). 3Y return: 25.27% (lower mid). 3Y return: 26.21% (upper mid). 3Y return: 27.77% (upper mid). 3Y return: 24.63% (bottom quartile). 3Y return: 25.22% (lower mid). 3Y return: 24.13% (bottom quartile). Point 7 1Y return: 164.13% (top quartile). 1Y return: 28.24% (top quartile). 1Y return: 26.83% (upper mid). 1Y return: 10.40% (bottom quartile). 1Y return: 18.57% (upper mid). 1Y return: 18.13% (lower mid). 1Y return: 17.13% (lower mid). 1Y return: 17.45% (lower mid). 1Y return: 11.15% (bottom quartile). 1Y return: 15.45% (bottom quartile). 1Y return: 20.54% (upper mid). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (top quartile). Alpha: -2.70 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: -6.08 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -6.78 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (top quartile). Sharpe: 0.53 (upper mid). Sharpe: 0.15 (lower mid). Sharpe: 0.08 (lower mid). Sharpe: 0.13 (lower mid). Sharpe: 0.21 (upper mid). Sharpe: 0.03 (bottom quartile). Sharpe: 0.06 (bottom quartile). Sharpe: -0.03 (bottom quartile). Sharpe: 0.29 (upper mid). Point 10 Information ratio: -0.47 (bottom quartile). Information ratio: -0.63 (bottom quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.29 (top quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.26 (top quartile). Information ratio: 0.00 (lower mid). DSP World Gold Fund

SBI PSU Fund

Invesco India PSU Equity Fund

ICICI Prudential Infrastructure Fund

DSP India T.I.G.E.R Fund

Canara Robeco Infrastructure

Franklin Build India Fund

LIC MF Infrastructure Fund

HDFC Infrastructure Fund

Nippon India Power and Infra Fund

BOI AXA Manufacturing and Infrastructure Fund

200 करोड़ 5 साल के कैलेंडर वर्ष के रिटर्न के आधार पर ऑर्डर किए गए म्यूचुअल फंड की इक्विटी श्रेणी में।1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (05 Mar 26) ₹63.9103 ↓ -2.35 (-3.55 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,843 28 Feb 23 ₹9,241 29 Feb 24 ₹8,778 28 Feb 25 ₹13,911 28 Feb 26 ₹41,909 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month 10.8% 3 Month 28.7% 6 Month 64.3% 1 Year 164.1% 3 Year 58.8% 5 Year 31% 10 Year 15 Year Since launch 10.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (06 Mar 26) ₹36.0126 ↓ -0.17 (-0.46 %) Net Assets (Cr) ₹5,980 on 31 Jan 26 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.63 Information Ratio -0.63 Alpha Ratio 0.05 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,846 28 Feb 23 ₹13,615 29 Feb 24 ₹26,250 28 Feb 25 ₹24,523 28 Feb 26 ₹34,330 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month 1.8% 3 Month 8.2% 6 Month 16.7% 1 Year 28.2% 3 Year 32.2% 5 Year 26.7% 10 Year 15 Year Since launch 8.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.67 Yr. Data below for SBI PSU Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 34.09% Utility 29.59% Energy 13.91% Industrials 12.42% Basic Materials 7.01% Asset Allocation

Asset Class Value Cash 2.9% Equity 97.02% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN18% ₹1,069 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL10% ₹583 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | NTPC9% ₹550 Cr 15,443,244 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | POWERGRID9% ₹511 Cr 19,935,554

↑ 2,300,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | GAIL8% ₹488 Cr 29,150,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | BPCL6% ₹354 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | BANKBARODA6% ₹329 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | NMDC4% ₹227 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB4% ₹221 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹196 Cr 3,850,000 3. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (06 Mar 26) ₹67.37 ↑ 0.19 (0.28 %) Net Assets (Cr) ₹1,492 on 31 Jan 26 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.53 Information Ratio -0.5 Alpha Ratio -2.7 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,709 28 Feb 23 ₹13,515 29 Feb 24 ₹25,468 28 Feb 25 ₹22,731 28 Feb 26 ₹31,469 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month 1.1% 3 Month 4.1% 6 Month 10.5% 1 Year 26.8% 3 Year 30.2% 5 Year 24.7% 10 Year 15 Year Since launch 12.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.59 Yr. Sagar Gandhi 1 Jul 25 0.59 Yr. Data below for Invesco India PSU Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 31.92% Financial Services 29.89% Utility 18.15% Energy 12.64% Basic Materials 4.19% Consumer Cyclical 1.08% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹139 Cr 1,294,989

↓ -92,628 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹135 Cr 2,997,692 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB7% ₹106 Cr 1,157,444 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | BPCL7% ₹99 Cr 2,717,009 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹87 Cr 187,643

↓ -8,515 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹79 Cr 9,129,820 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP5% ₹73 Cr 646,300 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹69 Cr 445,685 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | BANKBARODA5% ₹67 Cr 2,244,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | NTPC4% ₹64 Cr 1,801,543 4. ICICI Prudential Infrastructure Fund

ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (06 Mar 26) ₹188.58 ↓ -1.04 (-0.55 %) Net Assets (Cr) ₹8,077 on 31 Jan 26 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.15 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹13,019 28 Feb 23 ₹16,071 29 Feb 24 ₹26,195 28 Feb 25 ₹26,606 28 Feb 26 ₹31,983 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -3.5% 3 Month -3.7% 6 Month -1.7% 1 Year 10.4% 3 Year 22.8% 5 Year 24.6% 10 Year 15 Year Since launch 15.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.7% 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 8.67 Yr. Sharmila D’mello 30 Jun 22 3.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 48.97% Financial Services 12.33% Utility 9.63% Basic Materials 9.49% Real Estate 6.53% Energy 6% Consumer Cyclical 2.03% Communication Services 0.11% Asset Allocation

Asset Class Value Cash 4.63% Equity 95.37% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹690 Cr 1,755,704 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO8% ₹640 Cr 1,391,449

↑ 275,091 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | NTPC4% ₹332 Cr 9,326,448

↓ -1,050,000 Oberoi Realty Ltd (Real Estate)

Equity, Since 31 May 23 | OBEROIRLTY3% ₹253 Cr 1,696,181

↑ 637,668 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹241 Cr 1,700,000 AIA Engineering Ltd (Industrials)

Equity, Since 28 Feb 21 | AIAENG3% ₹229 Cr 574,561

↓ -37,559 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹221 Cr 1,931,967

↑ 20,847 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | INDUSINDBK3% ₹217 Cr 2,424,016 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹213 Cr 1,529,725 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹209 Cr 1,527,307

↓ -156,250 5. DSP India T.I.G.E.R Fund

DSP India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (06 Mar 26) ₹320.958 ↓ -0.49 (-0.15 %) Net Assets (Cr) ₹5,184 on 31 Jan 26 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.08 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,599 28 Feb 23 ₹14,649 29 Feb 24 ₹23,990 28 Feb 25 ₹23,841 28 Feb 26 ₹30,113 Returns for DSP India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month 1.6% 3 Month 3% 6 Month 3% 1 Year 18.6% 3 Year 25.4% 5 Year 23.4% 10 Year 15 Year Since launch 17.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 -2.5% 2023 32.4% 2022 49% 2021 13.9% 2020 51.6% 2019 2.7% 2018 6.7% 2017 -17.2% 2016 47% 2015 4.1% Fund Manager information for DSP India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 15.63 Yr. Data below for DSP India T.I.G.E.R Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 30.23% Basic Materials 14.52% Financial Services 12.4% Utility 11.04% Energy 8.15% Consumer Cyclical 8.07% Health Care 5.75% Communication Services 3.2% Technology 1.66% Real Estate 1.57% Consumer Defensive 1.34% Asset Allocation

Asset Class Value Cash 2.08% Equity 97.92% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT5% ₹267 Cr 678,645

↓ -15,823 NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | NTPC5% ₹254 Cr 7,145,883 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP4% ₹197 Cr 283,144

↑ 37,216 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX3% ₹172 Cr 680,825 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL3% ₹160 Cr 812,745 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Mar 24 | ONGC3% ₹153 Cr 5,686,486

↑ 1,321,459 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jan 25 | POWERGRID3% ₹143 Cr 5,567,574 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Oct 25 | HAL3% ₹141 Cr 305,098 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹136 Cr 1,154,264 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA2% ₹119 Cr 2,705,180

↓ -616,273 6. Canara Robeco Infrastructure

Canara Robeco Infrastructure

Growth Launch Date 2 Dec 05 NAV (06 Mar 26) ₹162.55 ↓ -0.09 (-0.06 %) Net Assets (Cr) ₹879 on 31 Jan 26 Category Equity - Sectoral AMC Canara Robeco Asset Management Co. Ltd. Rating Risk High Expense Ratio 2.32 Sharpe Ratio 0.13 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,941 28 Feb 23 ₹14,255 29 Feb 24 ₹21,721 28 Feb 25 ₹22,794 28 Feb 26 ₹29,026 Returns for Canara Robeco Infrastructure

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month 1% 3 Month 3.1% 6 Month 2% 1 Year 18.1% 3 Year 25.3% 5 Year 22.8% 10 Year 15 Year Since launch 14.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 0.1% 2023 35.3% 2022 41.2% 2021 9% 2020 56.1% 2019 9% 2018 2.3% 2017 -19.1% 2016 40.2% 2015 2.1% Fund Manager information for Canara Robeco Infrastructure

Name Since Tenure Vishal Mishra 26 Jun 21 4.61 Yr. Shridatta Bhandwaldar 29 Sep 18 7.35 Yr. Data below for Canara Robeco Infrastructure as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 45.41% Utility 12.54% Basic Materials 10.29% Energy 9.34% Financial Services 8.27% Technology 3.24% Communication Services 3.06% Consumer Cyclical 2.93% Real Estate 1.11% Asset Allocation

Asset Class Value Cash 3.81% Equity 96.19% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 28 Feb 11 | LT10% ₹85 Cr 214,901

↓ -3,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 24 | SBIN5% ₹48 Cr 442,500 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 22 | RELIANCE5% ₹41 Cr 291,750 NTPC Ltd (Utilities)

Equity, Since 30 Nov 18 | NTPC4% ₹39 Cr 1,106,480 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Jul 19 | BEL4% ₹39 Cr 869,000

↓ -25,000 Tata Power Co Ltd (Utilities)

Equity, Since 30 Sep 24 | TATAPOWER3% ₹30 Cr 810,000 GE Vernova T&D India Ltd (Industrials)

Equity, Since 31 Jan 24 | GVT&D3% ₹29 Cr 89,735

↓ -10,250 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 24 | BHARTIARTL3% ₹27 Cr 136,600 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Jan 23 | INDIGO3% ₹27 Cr 58,250 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 31 Oct 23 | CGPOWER3% ₹26 Cr 440,650 7. Franklin Build India Fund

Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (06 Mar 26) ₹143.766 ↓ -0.94 (-0.65 %) Net Assets (Cr) ₹3,003 on 31 Jan 26 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.01 Sharpe Ratio 0.21 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,098 28 Feb 23 ₹13,800 29 Feb 24 ₹23,698 28 Feb 25 ₹23,292 28 Feb 26 ₹29,368 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -1.7% 3 Month 0.8% 6 Month 2.9% 1 Year 17.1% 3 Year 26.2% 5 Year 22.7% 10 Year 15 Year Since launch 17.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.7% 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 4.29 Yr. Kiran Sebastian 7 Feb 22 3.99 Yr. Sandeep Manam 18 Oct 21 4.29 Yr. Data below for Franklin Build India Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 33.81% Financial Services 16.07% Utility 14.48% Energy 13.67% Communication Services 8.08% Basic Materials 5.58% Real Estate 2.64% Consumer Cyclical 1.25% Technology 1.16% Asset Allocation

Asset Class Value Cash 3.26% Equity 96.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹261 Cr 665,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | ONGC6% ₹184 Cr 6,825,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE6% ₹176 Cr 1,260,000

↑ 60,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹161 Cr 350,000

↑ 24,659 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | NTPC5% ₹142 Cr 3,978,727

↓ -371,273 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹140 Cr 710,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 25 | HDFCBANK5% ₹139 Cr 1,500,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | AXISBANK5% ₹137 Cr 1,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 14 | SBIN4% ₹108 Cr 1,000,000 REC Ltd (Financial Services)

Equity, Since 30 Sep 25 | RECLTD3% ₹98 Cr 2,700,000

↑ 400,000 8. LIC MF Infrastructure Fund

LIC MF Infrastructure Fund

Growth Launch Date 29 Feb 08 NAV (06 Mar 26) ₹49.1602 ↑ 0.07 (0.15 %) Net Assets (Cr) ₹946 on 31 Jan 26 Category Equity - Sectoral AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating Risk High Expense Ratio 2.21 Sharpe Ratio 0.03 Information Ratio 0.29 Alpha Ratio -6.08 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,622 28 Feb 23 ₹13,475 29 Feb 24 ₹21,758 28 Feb 25 ₹22,556 28 Feb 26 ₹29,283 Returns for LIC MF Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -0.8% 3 Month 1.1% 6 Month 1.4% 1 Year 17.4% 3 Year 27.8% 5 Year 22.5% 10 Year 15 Year Since launch 9.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.7% 2023 47.8% 2022 44.4% 2021 7.9% 2020 46.6% 2019 -0.1% 2018 13.3% 2017 -14.6% 2016 42.2% 2015 -2.2% Fund Manager information for LIC MF Infrastructure Fund

Name Since Tenure Yogesh Patil 18 Sep 20 5.38 Yr. Mahesh Bendre 1 Jul 24 1.59 Yr. Data below for LIC MF Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 48.01% Consumer Cyclical 14.5% Basic Materials 9.34% Financial Services 6.56% Utility 6.33% Technology 3.72% Real Estate 3.47% Health Care 3.21% Communication Services 2.91% Asset Allocation

Asset Class Value Cash 1.95% Equity 98.05% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tata Motors Ltd (Consumer Cyclical)

Equity, Since 31 Oct 25 | TMCV5% ₹48 Cr 1,051,964

↓ -36,431 Shakti Pumps (India) Ltd (Industrials)

Equity, Since 31 Mar 24 | SHAKTIPUMP5% ₹43 Cr 686,379 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 09 | LT5% ₹43 Cr 108,403 REC Ltd (Financial Services)

Equity, Since 31 Jul 23 | RECLTD3% ₹33 Cr 901,191 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Jun 25 | APOLLOHOSP3% ₹30 Cr 43,674 Garware Hi-Tech Films Ltd (Basic Materials)

Equity, Since 31 Aug 23 | 5006553% ₹28 Cr 93,271 Schneider Electric Infrastructure Ltd (Industrials)

Equity, Since 31 Dec 23 | SCHNEIDER3% ₹26 Cr 377,034

↑ 61,173 Bharat Bijlee Ltd (Industrials)

Equity, Since 31 Jul 22 | BBL3% ₹26 Cr 92,624 Avalon Technologies Ltd (Technology)

Equity, Since 31 Jul 23 | AVALON3% ₹25 Cr 289,118 Mahindra Lifespace Developers Ltd (Real Estate)

Equity, Since 30 Jun 24 | MAHLIFE3% ₹24 Cr 659,065 9. HDFC Infrastructure Fund

HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (06 Mar 26) ₹45.58 ↓ -0.41 (-0.88 %) Net Assets (Cr) ₹2,366 on 31 Jan 26 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.06 Sharpe Ratio 0.06 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,903 28 Feb 23 ₹13,888 29 Feb 24 ₹25,247 28 Feb 25 ₹24,286 28 Feb 26 ₹29,124 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -3.9% 3 Month -3.6% 6 Month -3.1% 1 Year 11.1% 3 Year 24.6% 5 Year 22.4% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 2.2% 2023 23% 2022 55.4% 2021 19.3% 2020 43.2% 2019 -7.5% 2018 -3.4% 2017 -29% 2016 43.3% 2015 -1.9% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Dhruv Muchhal 22 Jun 23 2.62 Yr. Ashish Shah 1 Nov 25 0.25 Yr. Data below for HDFC Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 40.3% Financial Services 21.02% Basic Materials 10.31% Energy 7.4% Utility 7.38% Communication Services 4.32% Real Estate 2.99% Health Care 1.84% Technology 1.33% Consumer Cyclical 0.67% Asset Allocation

Asset Class Value Cash 2.44% Equity 97.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT7% ₹159 Cr 403,500

↑ 6,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK6% ₹149 Cr 1,100,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK5% ₹130 Cr 1,400,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL4% ₹87 Cr 758,285 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL3% ₹80 Cr 1,400,000 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | NTPC3% ₹78 Cr 2,200,000 State Bank of India (Financial Services)

Equity, Since 31 Mar 08 | SBIN3% ₹76 Cr 704,361 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹70 Cr 500,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹69 Cr 150,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹69 Cr 350,000 10. Nippon India Power and Infra Fund

Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (06 Mar 26) ₹345.453 ↑ 0.02 (0.01 %) Net Assets (Cr) ₹6,773 on 31 Jan 26 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.85 Sharpe Ratio -0.03 Information Ratio 0.26 Alpha Ratio -6.78 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,969 28 Feb 23 ₹14,131 29 Feb 24 ₹25,118 28 Feb 25 ₹23,502 28 Feb 26 ₹29,232 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month 0.4% 3 Month 0.8% 6 Month 1.7% 1 Year 15.5% 3 Year 25.2% 5 Year 22.4% 10 Year 15 Year Since launch 17.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 -0.5% 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 7.7 Yr. Rahul Modi 19 Aug 24 1.45 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Power and Infra Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 31.76% Utility 24.23% Consumer Cyclical 11.14% Energy 10.76% Basic Materials 7.94% Technology 4.08% Communication Services 3.05% Financial Services 2.82% Health Care 2.16% Real Estate 1.9% Asset Allocation

Asset Class Value Cash 0.17% Equity 99.83% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE10% ₹650 Cr 4,660,000

↑ 110,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | NTPC9% ₹605 Cr 17,000,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT6% ₹389 Cr 989,337

↓ -75,000 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | TATAPOWER4% ₹289 Cr 7,900,789 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL3% ₹207 Cr 1,050,000

↓ -150,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | ULTRACEMCO3% ₹203 Cr 160,000

↓ -10,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 30 Sep 24 | CGPOWER3% ₹176 Cr 3,020,014 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 24 | BHEL3% ₹171 Cr 6,500,000

↓ -400,000 Bharat Forge Ltd (Consumer Cyclical)

Equity, Since 31 Oct 24 | BHARATFORG3% ₹170 Cr 1,179,635 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN2% ₹158 Cr 18,358,070

↑ 860,913 11. BOI AXA Manufacturing and Infrastructure Fund

BOI AXA Manufacturing and Infrastructure Fund

Growth Launch Date 5 Mar 10 NAV (06 Mar 26) ₹58.15 ↓ -0.08 (-0.14 %) Net Assets (Cr) ₹661 on 31 Jan 26 Category Equity - Sectoral AMC BOI AXA Investment Mngrs Private Ltd Rating Risk High Expense Ratio 2.4 Sharpe Ratio 0.29 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,732 28 Feb 23 ₹13,825 29 Feb 24 ₹21,962 28 Feb 25 ₹21,392 28 Feb 26 ₹27,781 Returns for BOI AXA Manufacturing and Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month -1.8% 3 Month 0.1% 6 Month 3.2% 1 Year 20.5% 3 Year 24.1% 5 Year 21.2% 10 Year 15 Year Since launch 11.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.8% 2023 25.7% 2022 44.7% 2021 3.3% 2020 52.5% 2019 28.1% 2018 2.5% 2017 -22.8% 2016 56% 2015 1% Fund Manager information for BOI AXA Manufacturing and Infrastructure Fund

Name Since Tenure Nitin Gosar 27 Sep 22 3.35 Yr. Data below for BOI AXA Manufacturing and Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 28.5% Basic Materials 18.14% Consumer Cyclical 14.63% Energy 11.96% Health Care 8.27% Utility 5.42% Real Estate 2.85% Communication Services 2.77% Consumer Defensive 1.52% Asset Allocation

Asset Class Value Cash 5.82% Equity 94.06% Debt 0.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 10 | LT9% ₹59 Cr 151,115 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 20 | RELIANCE7% ₹47 Cr 337,740 Vedanta Ltd (Basic Materials)

Equity, Since 31 Mar 24 | VEDL7% ₹46 Cr 678,238 NTPC Ltd (Utilities)

Equity, Since 31 May 21 | NTPC5% ₹36 Cr 1,006,566 Hero MotoCorp Ltd (Consumer Cyclical)

Equity, Since 30 Nov 23 | HEROMOTOCO3% ₹22 Cr 39,215 Oil India Ltd (Energy)

Equity, Since 31 Dec 23 | OIL3% ₹21 Cr 405,200

↑ 70,470 Lloyds Metals & Energy Ltd (Basic Materials)

Equity, Since 30 Nov 24 | 5124553% ₹20 Cr 178,702 Stylam Industries Ltd (Consumer Cyclical)

Equity, Since 30 Apr 25 | 5269513% ₹18 Cr 83,372 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 22 | BHARTIARTL3% ₹18 Cr 92,989 Aurobindo Pharma Ltd (Healthcare)

Equity, Since 31 May 25 | AUROPHARMA3% ₹17 Cr 144,862

निवेशकों को अपनी पसंद के SIP प्लान में निवेश करने की सलाह दी जाती है। उपर्युक्त शीर्ष 11 म्यूचुअल फंड सभी प्रकार के निवेशकों के लिए उपयुक्त हैं। तो, या तो आप एक उच्च जोखिम वाले हैंइन्वेस्टर या अपेक्षाकृत कम एक, ये एसआईपी फंड हैंनिवेश करने के लिए सर्वश्रेष्ठ म्युचुअल फंड. तो, प्रतीक्षा न करें, अभी निवेश करें!

सर्वोत्तम व्यवस्थित निवेश योजनाओं में निवेश करते समय विचार करने के लिए मानदंड

सबसे अच्छा प्रदर्शन करने वाले एसआईपी फंड का मूल्यांकन करने के लिए, आइए जानते हैं कि निवेश करने से पहले किन कारकों पर विचार करना चाहिए।

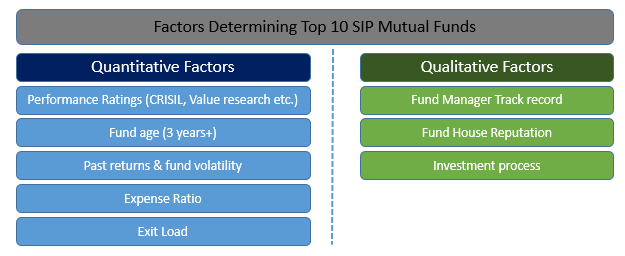

शीर्ष एसआईपी में निवेश करने के लिए मात्रात्मक कारक

एसआईपी के माध्यम से निवेश करने से पहले जिन मात्रात्मक कारकों पर विचार करना चाहिए, उनमें प्रदर्शन रेटिंग (क्रिसिल, वैल्यू रिसर्च आदि के अनुसार), फंड की उम्र, पिछले रिटर्न और फंड की अस्थिरता, व्यय अनुपात और एक्जिट लोड शामिल हैं।

शीर्ष एसआईपी में निवेश करने के लिए गुणात्मक कारक

विश्लेषण करने के लिए गुणात्मक प्रमुख आंकड़ों में फंड मैनेजर का ट्रैक रिकॉर्ड, फंड हाउस की प्रतिष्ठा और एसआईपी फंड की निवेश प्रक्रिया शामिल है।

एसआईपी एमएफ ऑनलाइन में निवेश कैसे करें?

Fincash.com पर आजीवन मुफ्त निवेश खाता खोलें

अपना पंजीकरण और केवाईसी प्रक्रिया पूरी करें

Upload Documents (PAN, Aadhaar, etc.). और, आप निवेश करने के लिए तैयार हैं!

आज ही SIP के साथ अपनी निवेश यात्रा शुरू करें!

पूछे जाने वाले प्रश्न

1. म्यूचुअल फंड क्या हैं?

ए: म्युचुअल फंड सिस्टमैटिक इन्वेस्टमेंट प्लान या एसआईपी का एक हिस्सा हैं जो आमतौर पर बाद में उत्कृष्ट रिटर्न देते हैं। जब आपम्युचुअल फंड में निवेश, आप अपने निवेश पोर्टफोलियो में विविधता लाते हैं। एक म्युचुअल फंड को एक निवेश उपकरण माना जा सकता है जिसे द्वारा विकसित किया गया हैएसेट मैनेजमेंट कंपनी कई निवेशकों और कंपनियों के निवेश में पूलिंग करके।

2. म्यूचुअल फंड के विभिन्न प्रकार क्या हैं?

ए: म्युचुअल फंड को मोटे तौर पर निम्नलिखित प्रकारों में वर्गीकृत किया जा सकता है:

- इक्विटी या ग्रोथ फंड

- फिक्स्ड इनकम फंड याडेट फंड

- टैक्स सेविंग फंड

- लिक्विड फंड

- बैलेंस्ड फंड

- गिल्ट फंड

- एक्सचेंज-ट्रेडेड फंड याईटीएफ

3. ग्रोथ इक्विटी फंड क्या हैं?

ए: विकासइक्विटी फ़ंड सबसे आम म्यूचुअल फंड हैं। हालांकि, इस पोर्टफोलियो में अस्थिर निवेश शामिल होंगे। फिर भी, निवेशक अक्सर ग्रोथ इक्विटी फंडों को पसंद करते हैं क्योंकि इनमें अधिक रिटर्न होता है और इन्हें कम अवधि के लिए निवेश किया जा सकता है।

4. आपको डेट फंड में निवेश क्यों करना चाहिए?

ए: ये निवेश उन व्यक्तियों के लिए आदर्श हैं जो निवेश पर निश्चित रिटर्न की तलाश में हैं। निश्चित आय डिबेंचर, ऋण प्रतिभूतियों, वाणिज्यिक पत्रों और सरकारी प्रतिभूतियों से अर्जित की जा सकती है। म्युचुअल फंड विभिन्न प्रकार के निवेशों का एक पोर्टफोलियो तैयार करेंगे और जोखिम को कम करेंगे।

5. आपको SIP में निवेश क्यों करना चाहिए?

ए: एसआईपी निवेशक को सुनिश्चित आय प्रदान कर सकता है। यदि आप निष्क्रिय आय अर्जित करने में रुचि रखते हैं और यह सुनिश्चित करना चाहते हैं कि आपका निवेश नियमित आय उत्पन्न करे, तो आप एसआईपी में निवेश करने पर विचार कर सकते हैं। .

6. टैक्स सेविंग म्यूचुअल फंड में निवेश क्यों करें?

ए: यदि आप अपना विकास करना चाहते हैंराजधानी और साथ ही टैक्स छूट का आनंद लेना चाहते हैं, तो आप टैक्स सेविंग म्यूचुअल फंड में निवेश कर सकते हैं। अंतर्गतधारा 80सी काआयकर 1861 का अधिनियम, यदि आप इक्विटी-लिंक्ड टैक्स सेविंग म्यूचुअल फंड में निवेश करते हैं, तो आप अपने निवेश पर कर छूट का आनंद ले सकते हैं।

7. क्या मुझे म्युचुअल फंड में निवेश करने के लिए ब्रोकर की आवश्यकता है?

ए: निवेश में आपकी सहायता के लिए आपको किसी ब्रोकर या वित्तीय संस्थान के समर्थन की आवश्यकता होगी। आपको उपयुक्त एसआईपी की पहचान करने और यह सुनिश्चित करने के लिए समर्थन की आवश्यकता होगी कि निवेश सही तरीके से किया गया है।

यहां प्रदान की गई जानकारी सटीक है, यह सुनिश्चित करने के लिए सभी प्रयास किए गए हैं। हालांकि, डेटा की शुद्धता के संबंध में कोई गारंटी नहीं दी जाती है। कृपया कोई भी निवेश करने से पहले योजना सूचना दस्तावेज के साथ सत्यापित करें।

Research Highlights for DSP World Gold Fund